Connecticut Partnership

Connecticut State is encouraging you, if it is affordable, to consider this special coverage. In essence a relatively small premium—and benefit—can protect ALL of your assets from spend down rules.

Office of Policy and Management

For details and costs and to see exactly how it can work for you, please call RetirementGuard at 888.793.6111 or e-mail us at helpme@retirementguard.com.

×

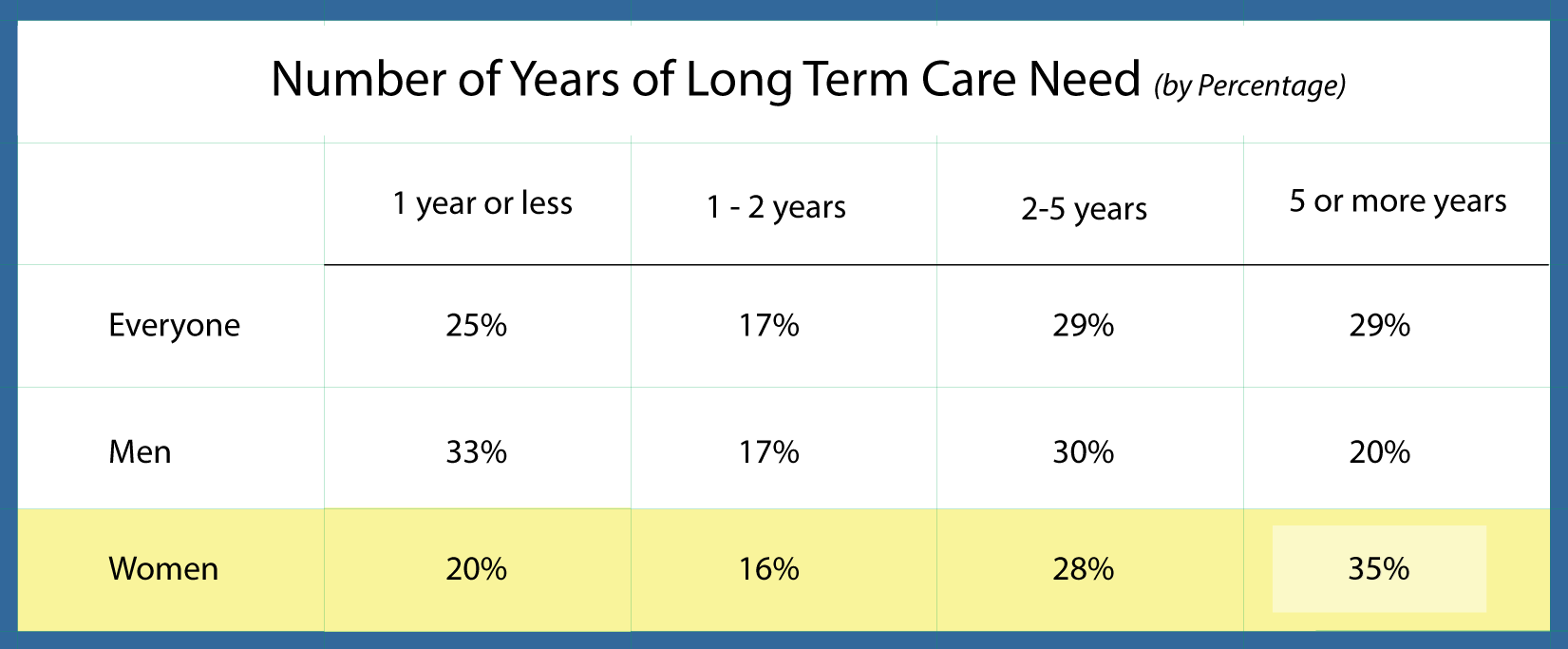

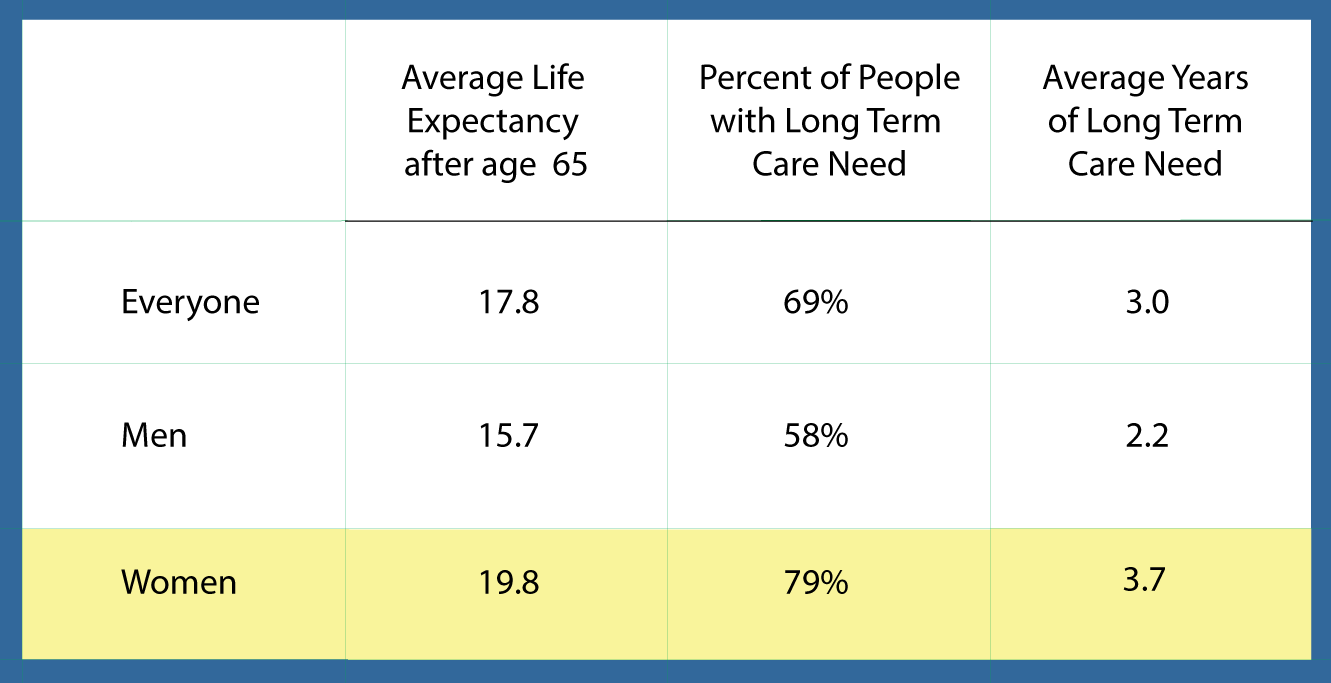

Long-Term Care is a Woman's Issue

70% of long-term care insurance claims are paid to women- and those claims last longer than claims paid to men

Currently premiums are NOT gender based, they are unisex. (Women and men pay the same) BUT that is about to change. Read a recent WSJ article

In 2013 women started to pay substantially higher premiums with some carriers than men. Our Exchange includes some rates that are still unisex.

For a very detailed report on women and long-term care, click here.

×

Privacy Policy

RetirementGuard's mission is to enhance quality of life and peace of mind. We believe the interest of our clients always come first. As a current or future client we need you to know that we are committed to maintaining your trust; protecting your privacy and the personal information you provide to us.

We only collect, use and share your personal information in order to provide you with and maintain the insurance products and services you have requested, or as permitted or required by law.

We will not share your information with any non-affiliated company for the purpose of that company marketing its products or services to you. We do not sell any information about you nor do we sell our customer lists.

Information collection

An essential part of the insurance application process is getting to know you. In this regard, we will need to collect some specific information from you and about you.

We will ask you to provide, among other things, personal data such as your name, address, date of birth, social security number, marital status, home address, phone numbers, email address and place of employment. In most cases you will also need to provide the names of your physicians, medications you are taking and illnesses or conditions you have or have had. Lastly, to ensure that you can afford the insurance you are interested in purchasing, questions related to your annual income range, savings and investments.

We would require the above information for the following:

- Illustrations & Proposals

- Financial Worksheets

- Long-Term Care Insurance Applications

- Servicing Your Account

Sharing information

When you provide information to us, we may share your information with our affiliated insurance companies for the purpose of fulfilling underwriting requests as well as offering you other services that may be of interest to you.

How is your information secured and protected?

We treat what we know about you confidentially. The website uses encryption and authentication tools to protect any personal information you send us via the Internet. Internally we take steps to make our computer data bases secure and to safeguard the information we have collected about you.

We require confidential treatment of your information and take care in handling your information. Employees who misuse customer information are subject to disciplinary action.

To contact us, to view or to update your information

If you wish to update or view your personal information or if you have any questions about this Privacy Policy, you may contact us by sending a letter via the U.S. Mail to:

- Craig Davis

- RetirementGuard, LLC

- PO Box 1686

- 333 Main Street

- Lakeville, CT 06039

- helpme@retirementguardcom

- toll-free:888.793.6111

- local:860.435.6622

×

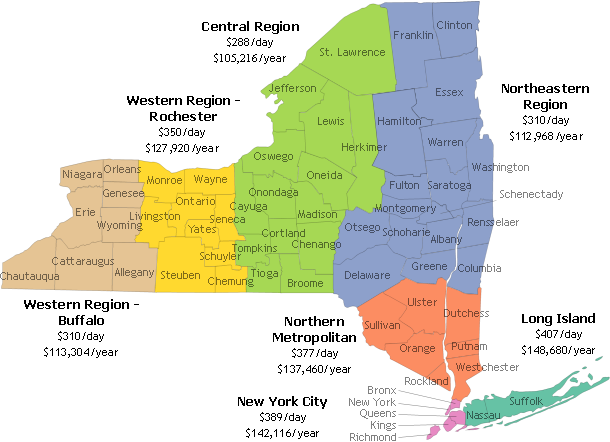

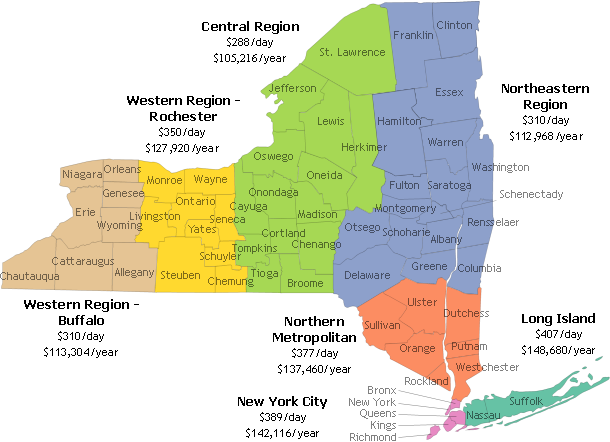

Estimated Average New York State Nursing Home Rates

It is important to note that these are average nursing home rates, and nursing home rates can be higher or lower depending on the type of facility you would prefer.

The largest catastrophic financial risk for most people is the potentially devastating cost associated with long term care. In 25 years these costs could exceed $1,000,000 or more.

×